United Rug Company is a small rug retailer owned and operated by Pat Kirwan. After the accounts have been adjusted on December 31, the following selected account balances were taken from the ledger:

Advertising Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 36,000 Depreciation Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,000 Freight In . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,000 Merchandise Inventory, January 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 375,000 Merchandise Inventory, December 31. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 460,000 Miscellaneous Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,000 Purchases. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,760,000 Purchases Discounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35,000 Purchases Returns and Allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,000 Pat Kirwan, Drawing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65,000 Salaries Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 375,000 Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,220,000

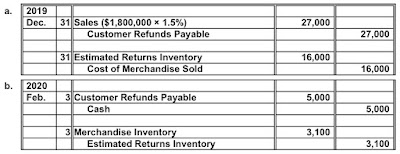

The estimated cost of merchandise returns from December sales is $20,000. Journalize the closing entries on December 31.

Answer:

Dec. 31 Merchandise Inventory (December 31) 460,000

Estimated Returns Inventory 20,000

Sales 2,220,000

Purchases Discounts 35,000

Purchases Returns and Allowances 45,000

Merchandise Inventory (January 1) 375,000

Purchases 1,760,000

Freight In 17,000

Salaries Expense 375,000

Advertising Expense 36,000

Depreciation Expense 13,000

Miscellaneous Expense 9,000

Pat Kirwan, Capital 195,000

31 Pat Kirwan, Capital 65,000

Pat Kirwan, Drawing 65,000