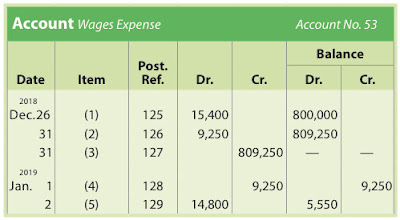

Account Wages Expense Account No. 53 Date Item Post. Ref. Dr. Cr. 2018 Dec. 26 (1) 125 15,400 800,000 31 (2) 126 9,250 809,250 31 (3) 127 809,250 — — 2019 Jan. 1 (4) 128 9,250 9,250 2 (5) 129 14,800 5,550

a. Indicate the nature of the entry (payment, adjusting, closing, reversing) from which each numbered posting was made.

b. Journalize the complete entry from which each numbered posting was made. Close revenues and expenses to D. Bower, Capital.

Answers:

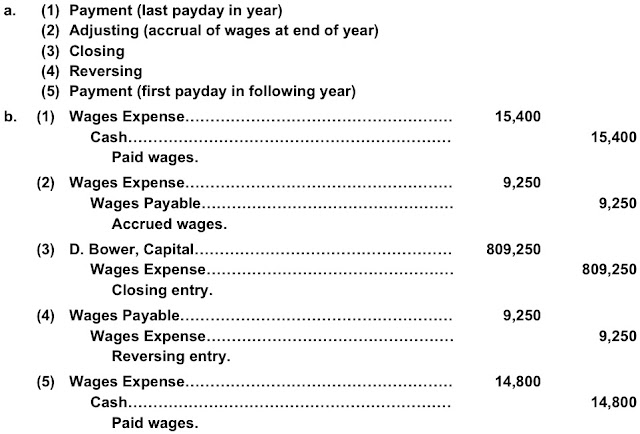

a. (1) Payment (last payday in year)

(2) Adjusting (accrual of wages at end of year)

(3) Closing

(4) Reversing

(5) Payment (first payday in following year)

b. (1) Wages Expense...................................................... 15,400

Cash.................................................................. 15,400

Paid wages.

(2) Wages Expense...................................................... 9,250

Wages Payable................................................... 9,250

Accrued wages.

(3) D. Bower, Capital................................................... 809,250

Wages Expense................................................... 809,250

Closing entry.

(4) Wages Payable...................................................... 9,250

Wages Expense................................................... 9,250

Reversing entry.

(5) Wages Expense...................................................... 14,800

Cash.................................................................. 14,800

Paid wages.

No comments:

Post a Comment