A F G 1 2 3 4 5 6 7 8 9 101 2 3 4 5 6 7 8 9

201 2 3 4 5 6 7 8 9

Finders Investigative Services End-of-Period Spreadsheet For the Year Ended June 30, 2019 Adjusted Trial Balance Dr. Cr.Account Title Cash Accounts Receivable Supplies Prepaid Insurance Building Accumulated Depreciation—Building Accounts Payable

Salaries Payable Unearned Rent Stacy Tanner, Capital Stacy Tanner, Drawing Service Fees Rent Revenue Salaries Expense Rent Expense Supplies Expense Depreciation Expense—Building Utilities Expense Repairs Expense Insurance Expense Miscellaneous Expense 718,000 12,000 28,000 69,600 4,600 2,500 439,500 12,000 44,200 11,700 3,000 2,000 373,800 522,100 48,000 10,800 8,750 7,150 3,000 2,500 6,200 1,164,700 1,164,700

Instructions

1. Prepare an income statement, a statement of owner’s equity (no additional investments were made during the year), and a balance sheet.

2. Journalize the entries that were required to close the accounts at June 30.

3. If Stacy Tanner, Capital has instead decreased $30,000 after the closing entries were posted, and the withdrawals remained the same, what would have been the amount of net income or net loss?

Answer:

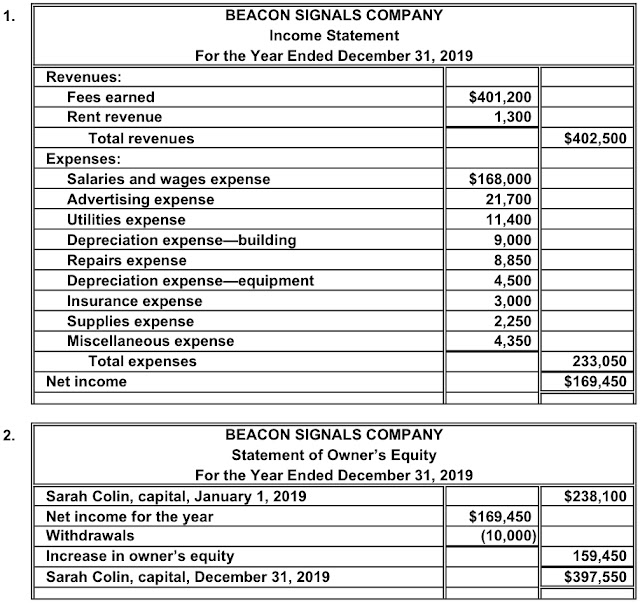

1.

Revenues:

Service fees$718,000

Rent revenue12,000

Total revenues$730,000

Expenses:

Salaries expense$522,100

Rent expense48,000

Supplies expense10,800

Depreciation expense—building 8,750

Utilities expense7,150

Repairs expense3,000

Insurance expense2,500

Miscellaneous expense6,200

Total expenses608,500

Net income$121,500

Stacy Tanner, capital, July 1, 2018$373,800

Net income for the year$121,500

Withdrawals(12,000)

Increase in owner’s equity109,500

Stacy Tanner, capital, June 30, 2019$483,300

Current assets:

Cash$28,000

Accounts receivable69,600

Supplies4,600

Prepaid insurance2,500

Total current assets$104,700

Property, plant, and equipment:

Building$439,500

Less accumulated depreciation 44,200

Total property, plant, and building395,300

Total assets$500,000

Current liabilities:

Accounts payable$11,700

Salaries payable3,000

Unearned rent2,000

Total liabilities$ 16,700

Stacy Tanner, capital483,300

Total liabilities and owner’s equity$500,000

2. 2019

June 30 Service Fees718,000

Rent Revenue12,000

Salaries Expense522,100

Rent Expense48,000

Supplies Expense10,800

Depreciation Expense—Building 8,750

Utilities Expense7,150

Repairs Expense3,000

Insurance Expense2,500

Miscellaneous Expense6,200

Stacy Tanner, Capital121,500

30 Stacy Tanner, Capital12,000

Stacy Tanner, Drawing12,000

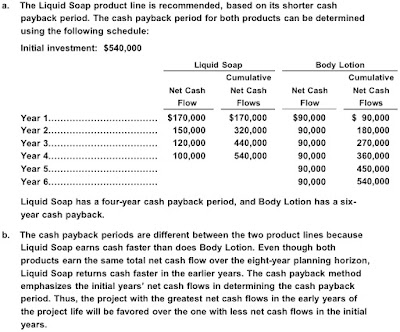

3. $(18,000) net loss ($30,000 – $12,000). The $30,000 decrease is caused by the

$(12,000) withdrawals and an $(18,000) net loss.