The beginning inventory for Midnight Supplies and data on purchases and sales for a three-month period are shown in Problem 7-1A.

Instructions

1. Determine the inventory on March 31 and the cost of merchandise sold for the three-month period, using the first-in, first-out method and the periodic inventory system.

2. Determine the inventory on March 31 and the cost of merchandise sold for the three-month period, using the last-in, first-out method and the periodic inventory system.

3. Determine the inventory on March 31 and the cost of merchandise sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the nearest cent.

4. Compare the gross profit and the March 31 inventories, using the following column headings:

FIFO LIFO Weighted Average Sales Cost of merchandise sold Gross profit Inventory, March 31

Answer:

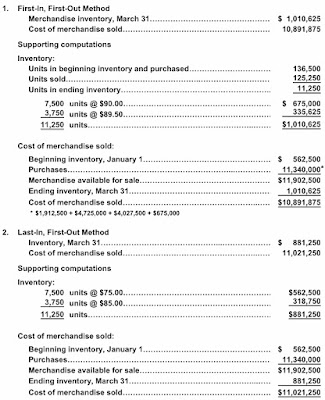

1. First-In, First-Out Method

Merchandise inventory, March 31................................................ $ 1,010,625

Cost of merchandise sold........................................................... 10,891,875

Supporting computations

Inventory:

Units in beginning inventory and purchased................................. 136,500

Units sold................................................................................ 125,250

Units in ending inventory........................................................... 11,250

7,500 units @ $90.00............................................................ $ 675,000

3,750 units @ $89.50............................................................ 335,625

11,250 units.......................................................................... $1,010,625

Cost of merchandise sold:

Beginning inventory, January 1................................................... $ 562,500

Purchases................................................................................. 11,340,000

Merchandise available for sale................................................... $11,902,500

Ending inventory, March 31......................................................... 1,010,625

Cost of merchandise sold........................................................... $10,891,875

* $1,912,500 + $4,725,000 + $4,027,500 + $675,000

2. Last-In, First-Out Method

Inventory, March 31..................................................................... $ 881,250

Cost of merchandise sold........................................................... 11,021,250

Supporting computations

Inventory:

7,500 units @ $75.00............................................................ $562,500

3,750 units @ $85.00............................................................ 318,750

11,250 units......................................................................... $881,250

Cost of merchandise sold:

Beginning inventory, January 1................................................... $ 562,500

Purchases................................................................................. 11,340,000

Merchandise available for sale................................................... $11,902,500

Ending inventory, March 31......................................................... 881,250

Cost of merchandise sold............................................................$11,021,250

3. Weighted Average Cost Method

Inventory, March 31.........................................................$ 981,000

Cost of merchandise sold................................................ 10,921,500

Supporting computations

$11,902,500

136,500 units

Inventory:

11,250 units × $87.20 = $981,000

Cost of merchandise sold:

Beginning inventory, January 1..........................................$ 562,500

Purchases..................................................................... 11,340,000

Merchandise available for sale..........................................$11,902,500

Ending inventory, March 31............................................. 981,000

Cost of merchandise sold................................................ $10,921,500

4.Weighted

FIFO LIFO Average

Sales$19,875,000 $19,875,000 $19,875,000

Cost of merchandise sold 10,891,875 11,021,250 10,921,500

Gross profit $ 8,983,125 $ 8,853,750 $ 8,953,500

Inventory, March 31 $ 1,010,625 $ 881,250 $ 981,000

* ($1,687,500 + $562,500 + $225,000 + $4,320,000 + $4,080,000 + $4,800,000 + $4,200,000)

No comments:

Post a Comment