Actual: Variable factory overhead$458,000

Fixed factory overhead494,000

Standard: 132,000 hrs. at $7.30 ($3.50 for variable factory overhead) 963,600

Productive capacity at 100% of normal was 130,000 hours, and the factory overhead cost budgeted at the level of 132,000 standard hours was $956,000. Based on these data, the chief cost accountant prepared the following variance analysis:

Variable factory overhead controllable variance:

Actual variable factory overhead cost incurred $458,000

Budgeted variable factory overhead for 132,000 hours 462,000

Variance—favorable–$ 4,000

Fixed factory overhead volume variance:

Normal productive capacity at 100% 130,000 hrs.

Standard for amount produced 132,000

Productive capacity not used 2,000 hrs.

Standard variable factory overhead rate × $7.30

Variance—unfavorable14,600

Total factory overhead cost variance—unfavorable $10,600

Identify the errors in the factory overhead cost variance analysis.

Answer:

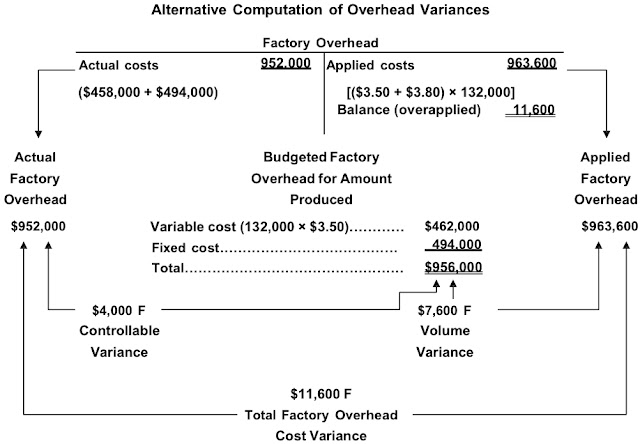

In determining the volume variance, the productive capacity overemployed (2,000 hours) should be multiplied by the standard fixed factory overhead rate of $3.80 ($7.30 – $3.50) to yield a favorable variance of $7,600. The variance analysis provided by the chief cost accountant incorrectly multiplied the 2,000 hours by the total factory overhead rate of $7.30 per hour and reported it as unfavorable.

A correct determination of the factory overhead cost variances is as follows:

Variable factory overhead controllable variance:

Actual variable factory overhead cost incurred…………………… $458,000

Budgeted variable factory overhead for 132,000

hours (132,000 × $3.50)……………………………………………… 462,000

Variance—favorable………………………………………………… $ (4,000)

Fixed factory overhead volume variance:

Productive capacity at 100%…………………………………………… 130,000

hrs.

Standard for amount produced……………………………………… 132,000 hrs.

Productive capacity overemployed………………………………… (2,000) hrs.

× Standard fixed factory overhead rate……………………………… × $3.80

Variance—favorable………………………………………………… (7,600)

Total factory overhead cost variance—favorable…………………… $(11,600)

No comments:

Post a Comment