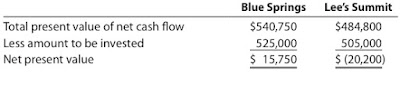

Blue Springs Lee’s Summit

Total present value of net cash flow $540,750 $484,800

Less amount to be invested 525,000 505,000

Net present value $ 15,750 $ (20,200)

a. Determine the present value index for each proposal.

b. Which location does your analysis support?

Answer:

a. Present Value Index =

Total Present Value of Net Cash Flow

Amount to Be Invested

Present value index

of Blue Springs: =

Present value index

of Lee’s Summit: =

$540,750

$525,000

$484,800

$505,000

= 1.03

= 0.96

b. The analysis supports investing in Blue Springs because the present value

index is greater than one. The Lee’s Summit investment is not supported.

No comments:

Post a Comment