Instructions

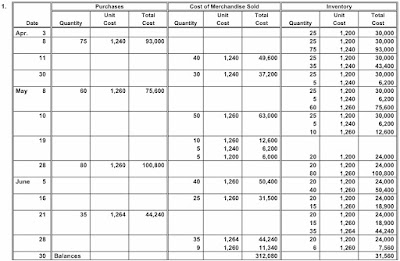

1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method.

2. Determine the total sales, the total cost of merchandise sold, and the gross profit from sales for the period.

3. Determine the ending inventory cost on June 30.

Answer:

1.

Unit Total Unit Total Unit Total

Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost

Apr. 325 1,200 30,000

8 75 1,240 93,00025 1,200 30,000

75 1,240 93,000

1140 1,240 49,600 25 1,200 30,000

35 1,240 43,400

3030 1,240 37,200 25 1,200 30,000

5 1,240 6,200

May 8 60 1,260 75,60025 1,200 30,000

5 1,240 6,200

60 1,260 75,600

1050 1,260 63,000 25 1,200 30,000

5 1,240 6,200

10 1,260 12,600

1910 1,260 12,600

5 1,240 6,200

5 1,200 6,000 20 1,200 24,000

28 80 1,260 100,80020 1,200 24,000

80 1,260 100,800

June 540 1,260 50,400 20 1,200 24,000

40 1,260 50,400

1625 1,260 31,500 20 1,200 24,000

15 1,260 18,900

21 35 1,264 44,24020 1,200 24,000

15 1,260 18,900

35 1,264 44,240

2835 1,264 44,240 20 1,200 24,000

9 1,260 11,340 6 1,260 7,560

30 Balances312,08031,560

2. Total sales.................................................................................... $525,250

Total cost of merchandise sold......................................................... 312,080

Gross profit.................................................................................... $213,170

*$525,250 = $80,000 + $60,000 + $100,000 + $40,000 + $90,000 + $56,250 + $99,000

3. $31,560 = [(20 units × $1,200) + (6 units × $1,260)]

= $24,000 + $7,560